How to get amazon w2 former employee.

Amazon requires all Associates to provide valid taxpayer identification information. The new tax interview automatically validates your information against IRS records. The tax interview must be completed and validated with the Internal Revenue Service (IRS) before you can receive payment of commissions earned as an Affiliate Marketer through …

Get Form W-2 As A Former Employee. As a former employee of Amazon navigating the intricacies of obtaining your Form W-2, the following options are available to facilitate a seamless process for filing last year’s tax returns, even if you are no longer employed by Amazon. 1.We would like to show you a description here but the site won’t allow us.This item W2 Forms 2023, Complete Laser W-2 Tax Forms and W-3 Transmittal - Kit for 10 Employees 6-Part W-2 Forms with 10 Self-Seal Envelopes in Value Pack | W-2 Forms 2023 NextDayLabels - 2023 3-Up W-2 Tax Forms (100 Sheets & Envelopes) for Laser or Inkjet, 24 lb. Paper, Instructions Printed on The Back, Compatible with QuickBooks and ...Go to Federal>Wages & Income to enter a W-2. After you enter the first one, you click Add Another W-2. W-2's come from your employer, and they have until January 31 to issue it. Some employers allow you to import the W-2 through the software, but for security reasons you still need information from the actual W-2 to import it.

However, if you need to get in touch with Amazon’s Human Resources (HR), you can reach the Employee Resource Center (ERC) in the United States by calling 1-888-892-7180. When you call Amazon’s Human Resources (HR) department, you will encounter several automated options: Press 1 if you need information or assistance with Leave of …

Get the tax forms and envelopes you need to file W-2 forms for 26 employees; includes 6-part W2 tax form sets, peel and seal security envelopes and 3 W-3 summary reports ; Use Form W-2 to report employee wages, tips and taxes withheld to the Social Security Administration and your employeesAdd the Circle k w2 former employee for redacting. Click on the New Document button above, then drag and drop the document to the upload area, import it from the cloud, or using a link. Change your document. Make any changes required: insert text and photos to your Circle k w2 former employee, highlight details that matter, erase sections of …

Learn how to get your W-2 from Amazon after leaving the company. Find answers from experts and former employees on Intuit.Getting your W2 form from Amazon warehouse is easy and can be done through the ADP portal on your Amazon employee account. If you never received your …A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order.I got mine around this time (maybe a bit later but before February last year). The number is probably just HRs number. I don’t have it saved but I can grab it when I go to work tomorrow. Has anyone gotten the email yet? I also need my w2 and am not an employee anymore. 75K subscribers in the bathandbodyworks community.

A subreddit for those who want to end work, are curious about ending work, want to get the most out of a work-free life, want more information on anti-work ideas and want personal help with their own jobs/work-related struggles.

If you own a business, you know that you have a federal employee identification number (FEIN), also known as your federal tax ID number or employer identification number. One of th...

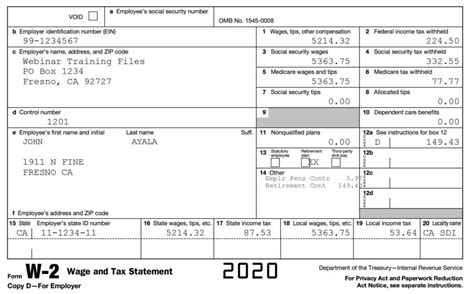

We will issue a 1099 form by January 29 to any Amazon Associate who received payments of $600 or more or received payments where taxes were withheld in the ...Page Last Reviewed or Updated: 29-Jan-2024. Information about Form W-2, Wage and Tax Statement, including recent updates, related forms and instructions on how to file. Form W-2 is filed by employers to report wages, tips, and other compensation paid to employees as well as FICA and withheld income taxes.A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order.Ryder Employee W2 Form – Form W-2, also referred to as the Wage and Tax Statement, is the document a company is required to send to each worker and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees’ yearly incomes and the quantity of taxes kept from their paychecks. A W-2 worker is somebody …Form W-2 Errors/Issues. Questions / Errors: If you have questions about your Form W-2 or Form 1099, or the information on your form is incorrect, please contact your company’s Payroll or HR department, or read our Form W-2 and 1099 Guide for Employees.Sign in to ADP®. Want to view your pay stub, download a W-2, enroll for benefits, or access your 401 (k) account? You name it, and we can help you get to the right place to do it even if you have never signed in before! Pick the option that describes you best: Select. cancel. Log in to any ADP product for pay, benefits, time, taxes, retirement ...Form W-2 Errors/Issues. Questions / Errors: If you have questions about your Form W-2 or Form 1099, or the information on your form is incorrect, please contact your company’s Payroll or HR department, or read our Form W-2 and 1099 Guide for Employees.

If you file without the form W-2, the IRS will not be able to process your application. So, it is necessary to get the Bath and Body Works form. Detailed aspects of a W2 form. The W-2 form, also called the Wage and Tax Statement includes information about the taxes withheld and an employee’s wages in a year.Page Last Reviewed or Updated: 29-Jan-2024. Information about Form W-2, Wage and Tax Statement, including recent updates, related forms and instructions on how to file. Form W-2 is filed by employers to report wages, tips, and other compensation paid to employees as well as FICA and withheld income taxes.As the deadline for filing taxes in the United States approaches, employees around the country begin receiving the forms they need to complete their tax returns. This distinction i...Once you are in click on the payroll link and you should see and option to view W-2 Forms on left hand side. You can save as PDF or print from there. If this does not work the General Office number is 614-278-6800 and you can navigate to the correct department from there. 2.Retention bonus tax for employees is considered on a case-by-case basis, according to Elaine Varelas for the Boston Globe. A retention bonus is considered for tax in the year that ...Alex_Masterson13. •. IF you received a paycheck, even if no taxes were taken out, they still are required by law to get you a W2. If it was not mailed to you, then it is probably sitting in the safe at the location you worked. You will just have to go there in person and ask for it. Reply.

As the deadline for filing taxes in the United States approaches, employees around the country begin receiving the forms they need to complete their tax returns. This distinction i...

Step 1: Access the Amazon A to Z Portal. To access your W2 form, you will need to log in to the Amazon A to Z portal. This portal is an excellent resource for Amazon employees and provides access to important information such as paystubs, benefits, and tax documents. Step 1.1: Create an Account.Here's how: Click Employees at the top menu bar, select Payroll Tax Forms & W-2s, and choose Process Payroll Forms. From the File Forms tab, scroll down and select Annual Form W-2/W-3 - Wage and Tax Statement/ Transmittal. Select Create Form and choose the terminated employee to file. Enter the year, then select OK. Adams W2 Forms 2020, Tax Kit for 12 Employees, 6-Part Laser W2 Forms, 3 W3, Self Seal W2 Envelopes & Adams Tax Forms Helper Online (TXA12618-20), White, 8-1/2 x 11. 340. 50+ bought in past month. $1462. FREE delivery Fri, Feb 9 on $35 of items shipped by Amazon. Or fastest delivery Wed, Feb 7. For employees on leave and former employees. Income verification. The Work Number layer. ... W-2 Tax Statements. Pay. Payslips and W-2s. Workday layer. For active employees* *From the Pay icon, click Payslips under the View menu. The PDF is your official payslip. My Benefits Resources layer. For employees on leave and former …Employers can opt to send the Form W2 to their employees via mail or provide it online through employee portals. Form W2 is a mandatory tax document that employers file with the Social Security Administration and IRS for tax purposes. SSA uses W2 along with W3 for the calculation of social security benefits each employee is entitled to. The Form W2 of …Blank W2 4 Up Tax Forms 2023, 25 Employees kit, with 25 Self-Seal Envelopes, Instructions in Back of The Forms, Great for QuickBooks and Accounting Software, Idea for E-Filing, W2 4-Up 2023. 1. $2149. FREE delivery Fri, Feb 16 on $35 of items shipped by Amazon. Only 3 left in stock - order soon.Add the Circle k w2 former employee for redacting. Click on the New Document button above, then drag and drop the document to the upload area, import it from the cloud, or using a link. Change your document. Make any changes required: insert text and photos to your Circle k w2 former employee, highlight details that matter, erase sections of …In today’s digital age, businesses are constantly seeking ways to streamline their operations and improve efficiency. One area that often proves to be time-consuming and resource-i...Or look up Prior bath and body works associate W2 instructions. If you accidentally delete the app PingID like I did. I would contact HR Direct: 866.473.4728 to get the PingID removed from the device and then reconnect your phone to the app. Then follow the instructions from top to bottom. Reply More replies.

Buc-ee’s Employee W2 Form. Buc-ee’s Employee W2 Form – Form W-2, also referred to as the Wage and Tax Statement, is the document an employer is required to send out to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports staff members’ yearly wages and the quantity of taxes kept from …

In today’s digital age, many aspects of our lives have become streamlined and more efficient. From online banking to shopping, technology has transformed various industries. One ar...

Once you’ve received your W2 form from Amazon Flex, you’ll need to use it to file your taxes. You can either file your taxes online or by mail. If you’re unsure about how to file your taxes, you may want to consider hiring a tax professional to help you. Conclusion. Getting your W2 form from Amazon Flex is crucial for filing your taxes.If there’s an error on your W-2, please ask your employer’s payroll or HR contact for help. They are the only ones who can make changes to your W-2. How do I access my W-2 from a previous employer? If you have previously logged into the ADP portal to get your paystub or W-2 from your former employer, you can try and access your information.When I try to reset the password it sends the reset email to my Bestbuy email that no longer exits. I attempted to call best but HR and just got into an automated voice looop. It’s like the only option for w-2s is to have them “send a copy” which COSTS MONEY. I refuse to pay for something I’m entitled too for free.1. 4. 380. Add a comment. Sort by : Oldest. Google kebrjbdh Jan 30, 2023. Go to ADP then select “my former employer uses ADP”, they will ask you to fill some infos then you can …In today’s digital age, many businesses are transitioning from traditional paper-based systems to online platforms for managing various aspects of their operations. One area where ...Use the ADP app and during the setup process there's an option that says something like previous employer used ADP. As for the alumni login thing, there's a certain step you can't skip that you are probably skipping. When logging in there's an option somewhere to for the alumni thing and they will email you a temporary password. Get Form W-2 As A Former Employee. As a former employee of Amazon navigating the intricacies of obtaining your Form W-2, the following options are available to facilitate a seamless process for filing last year’s tax returns, even if you are no longer employed by Amazon. 1. Blank W2 4 Up Tax Forms 2023, 25 Employees kit, with 25 Self-Seal Envelopes, Instructions in Back of The Forms, Great for QuickBooks and Accounting Software, Idea for E-Filing, W2 4-Up 2023. 1. $2149. FREE delivery Fri, Feb 16 on $35 of items shipped by Amazon. Only 3 left in stock - order soon.To fill out a W-2 form, start with the company and employee’s basic information. Calculate wages, tips and other income, then fill in allotted boxes for taxes withheld. Finish by i...Welcome Back. The Ohio Former Employee Portal answers common questions you may have after leaving state employment and allows you to log in and view old pay statements, download tax documents, and update your information with the State of Ohio.Aug 6, 2019 · This item Blank W2 Forms, 2023 4 Up W2 Tax Forms, 100 Employee Forms, Designed for QuickBooks and Accounting Software, Ideal for E-Filing, Works with Laser or Inkjet Printers, 100 Four Part Forms NextDayLabels - (1 Pack - 100 Sheets) W-2 4-Up Employee Tax Forms, Instructions on Back" for 2023, for Laser/Inkjet Printer.

If you are a former team member or do not wish to use your company credentials, select “MHC Knowledge Based Authentication” from the drop down, then click on “Register User” to create a login with MHC. You will need your Social Security Number (XXXXXXXXX). Login. Username. Password . Session Expiring Soon! your session is expiring …Welcome to ADP W-2 Services. Click to log in and enter your user name and password.This subreddit is for sharing news and information regarding the inner workings of the US Federal Government for Federal Employees. Fed news Government news Federal employment Federal employee Government employee This subreddit is not affiliated, sponsored, or in any way supported by the US Federal Government. 87K Members 93 …Instagram:https://instagram. hocus pocus showtimes near marcus parkwood cinemacity national bank cardholder preferred seatinglouisiana gun shows 2024hecate tattoos Nov 12, 2022 · To get your W2 from Amazon Flex, you need to log in to your Amazon Flex account and download it from there. Follow these steps: Log in to your Amazon Flex account. Click on the “Tax Information” tab. Click on “Download” next to your W2 form. Save the form to your computer or print it out for your records. gas station fort lauderdale airportbar rescue wrigleyville ByZippia Team- Aug. 8, 2023. You must contact Walmart's Payroll Services Department in order to get your W2 from Walmart as a former employee. The Payroll Services Department can assist you in obtaining your W2 form or recovering a misplaced W2 form. To contact Walmart's Payroll Services Department, call them directly at their dedicated …6. Because your information may contain sensitive data, L Brands requires two forms of authentication. a) To authenticate, follow the instructions on the screen or: Select “Click here to select email or other Multi Factor Authentication (MFA) methods” Choose to receive a passcode via SMS (text message) or via email, or ent federal credit union login page Former employee trying to get w2. Closed. Hi. I am a former employee having quit in January of 2021. I am concerned about my W2 because I have no access to a portal to retrieve it, and haven't gotten an email. I also have since moved and there is a mail forwarding in place, but as of 2/1/22 I haven't received anything regarding my W2.As an employee, it is important to have a clear understanding of your income and the taxes that are deducted from your paycheck. However, calculating payroll withholding can be com...Oct 19, 2023 · Answer. Yes, but an actual copy of your Form W-2 is only available if you submitted it with a paper tax return: Transcript. You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page.